OUR DATA PORTAL Emergent RiskIQ Login

Disrupting the Friendly Skies

United States/ Global: Airline CEOs met in Boston starting on Sunday, October 3 to discuss the future of the industry amid existential problems including flagging business travel and the industry’s collective impact on climate change.

Industry challenges facing air travel reflect a high-profile version of the convergence of strategic and tactical risk management problems facing organizations across industries. While airlines were not without problems going into the pandemic, the near-overnight loss of business, coupled with the most acute impacts of an airborne virus that can infect large numbers of people traveling for hours in a confined space has made it a poster child for the perfect storm of strategic and tactical impacts of what was once viewed as a low probability high impact scenario. The problem set underscores a need for disruptive new ideas that can drive this, and other industries forward into a future that is less friendly to old ways of transporting, traveling and interacting.

The COVID-19 Problem

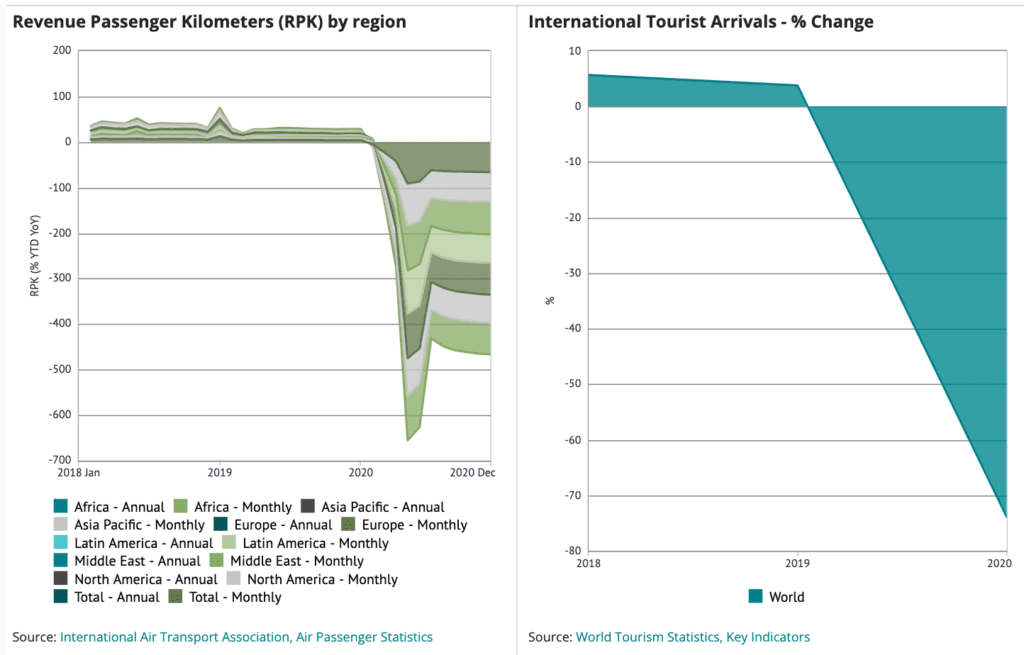

In 2020, the global airline industry lost approximately $126 billion dollars collectively, according to the International Air Transportation Association (IATA). This year it is likely to lose a further $48 billion – an improvement, but a far cry from pre-pandemic profit margins. The loss of business travel was a key factor in pandemic-related revenue loss, with business travel accounting for a larger and more lucrative portion of global travel revenue than tourism, particularly from the US and Europe. According to recent IATA analysis, ticket sales are holding at 42% of 2019 levels, while in 2020 they ended the year at 24% of 2019 levels. A central question that will arise at the conference, will business travel ever return to normal? While airlines are looking to a reopening of EU travel to the US in November to boost current margins, the shift is unlikely to bring about long-term recovery just yet. And if doesn’t, how does that impact future profitability – and the future of air travel? Articles and opinions abound about whether business travel will return to the pace it moved at pre-2020, with global meetings, conferences, and face-to-face working with partners globally creating constant cross-continental movement, stimulating a lucrative conference, hospitality and travel sector. But as the future of work has shifted as a result of a rapid pivot to mostly remote work, businesses have begun to reassess the importance of such travel, particularly as the savings from a lack of travel and the increased productivity of the work from home culture raised the question of its true necessity.

Industry challenges facing air travel reflect a high-profile version of the convergence of strategic and tactical risk management problems facing organizations across industries

The Climate Problem

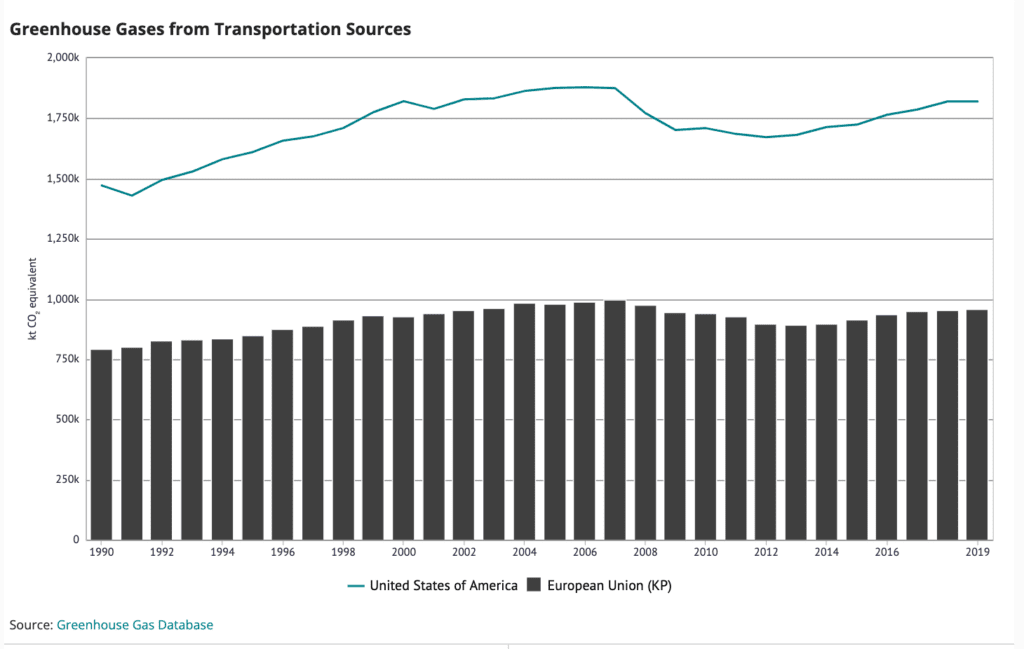

But near-term necessity is not the only existential question facing the airlines, and fixing the demand problem will increase the climate problem. Before COVID, activists and some governments sought to reign in the climate impact of global air travel and operations. In Europe, Greta Thunberg’s global climate movement inspired people and countries to reassess the necessity of air travel, with some governments considering extreme measures like banning air travel to cities where rail travel is possible – a move that could be a death knell for the European air industry. More commonly, governments are looking to substantially raise taxes on emission-heavy businesses like air travel until it finds a means of becoming more climate neutral. Like the fossil fuel industry itself, air travel has come under strong pressure to address its carbon footprint, which accounts for around 3% – 4% of global emissions, but which is expected to triple by 2050, according to the UN. An independent study by the International Clean Air Council suggested in 2019 that the number could actually be 1.5 times the UN estimate, based on pre-pandemic demand for air travel. Despite a brief respite from activist pressure while the world was distracted by the pandemic, concerns are high that the industry may not be able to shift quickly enough to curb its impact on climate change. Inability to do so will increase regulatory, investor and public pressure on the industry, potentially further devolving its overall ability to recover financially and to meet the needs of 21st century global transit. The climate problems plaguing airlines are not confined just to their companies however. Multinational companies are being asked by investors and activists to reveal how much their employees are traveling and factor this into their overall footprint too, which is likely to further deter a return to status quo travel anytime soon.

The Security Problem

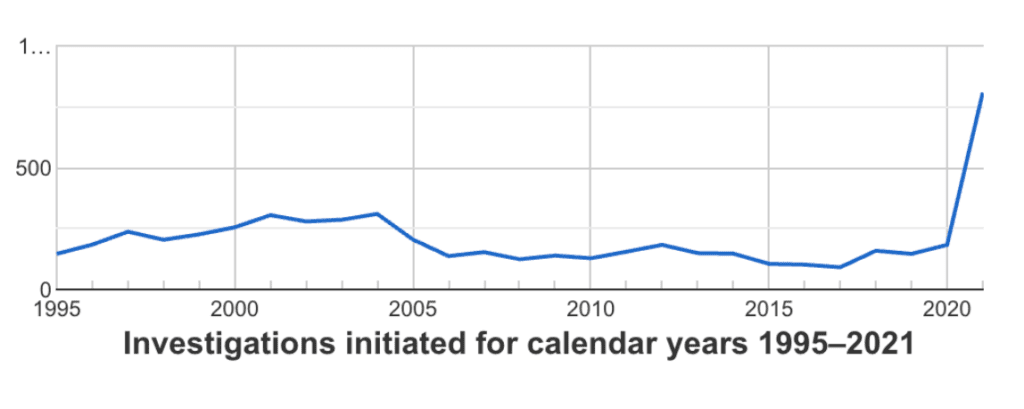

Meanwhile, the airline industry – like many public-facing organizations – has been caught up in the culture and political wars over COVID-19 mitigations. Flying, which had long ceased to be an enjoyable experience due to cramped cabins and stripped-down services, became even more fraught as passengers worried about the health of those in the seat next to them. Passengers not onboard with being forced to wear masks have become increasingly combative, with the industry experiencing an exponential rise in violent incidents onboard planes since the beginning of 2021 when the FAA initiated its zero tolerance policy requiring that every person traveling on an airplane in the US wear a mask at all times. Since January of this year there have been more than 4,498 incidents of unruly behavior, with more than a third of these incidents linked to enforcement of mask policies.

What to Watch for: Re-Imagining Industry

The airlines’ problems are ripe for disruption – as are other industries that face similar problems. Cruise lines, movie theaters, fossil fuels, retail and other public-facing venues all need to consider a future where we interact differently and power our movements around the globe differently. Similarly, any industry that utilizes air freight or maritime shipping as part of their supply chain will come under pressure for their contribution to climate change. Pandemics will emerge again, long before 100 years from now, and changes made now could mitigate economic impacts and shorten the timeline of disruption. Companies like United Airlines are backing efforts to find new means of powering planes, like electric and solar. Earlier this year the airline announced that it would invest $20 million in electric air taxi start-up Archer Aviation and plans to buy as many as 200 of its planes. These, however, are a short-haul bet, as batteries are not yet capable of powering planes for long-haul flights. Plane manufacturer, Airbus, meanwhile, is experimenting with three different hydrogen fuel models for planes of the future. As for getting passengers back and keeping them happy, a range of new digital initiatives emerged this year and last to better serve passengers, from new personalized entertainment options, to custom food delivery to plane passengers ahead of their flights. Ways to make airline cabins more personal or to separate individuals have yet to emerge in any economically viable model yet, however. Meanwhile, airlines began pressing Congress for more action on unruly passengers last week, suggesting no-fly lists for passengers involved in incidents that threaten the safety of airline personnel.

Sign up for our Newsletter

ERI has offices in the United States, Singapore, the United Kingdom and Ireland. Want to know more?